What is the current status of the international metals market? How does this differ from several years ago, and most importantly: how are supply and demand set to evolve? Graeme Train, market expert at commodities trader Trafigura, provides us with a status report of the global commodities trade.

In the 10 years following the 2008 global banking crisis, governments greatly reduced infrastructure spending, while many companies moved their production to Asia. ‘That had a significant impact on the metals sector’, says Graeme Train, Head of Metals & Minerals Analysis at Trafigura, Nyrstar’s parent company.

As a market expert, it’s his job to analyse the macroeconomic outlook on commodity markets and to map the carbon footprint of the commodity supply chain and the entire value chain behind it.

‘I often describe the period 2010 to 2020 as a lost decade for Western metal consumption. Demand for zinc also fell in this period. That was very unusual. It was the first long-term decline in metal demand for a hundred years.’

Rising demand

The cards have since been reshuffled. The global focus on energy transition is causing investment in infrastructure to increase significantly.

‘There are many factors further driving demand for zinc and other metals: international post-Covid recovery plans and the desire to accelerate independence from Russian gas, influenced by war developments in Ukraine’, explains Graeme Train.

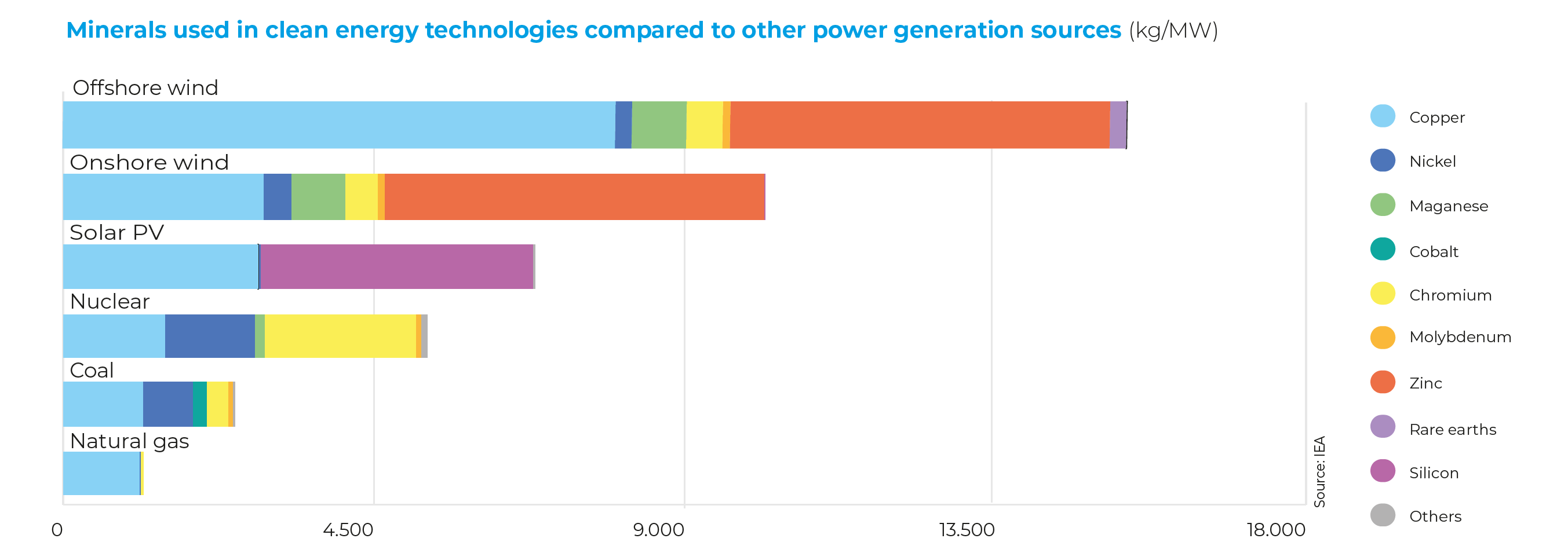

‘Governments and companies need these metals to build electricity infrastructure, energy pipelines, wind turbines and solar farms, among other things. The automotive sector also needs more zinc due to the increased demand for electric cars, both for making their bodywork more durable, and for their rechargeable batteries.’

Additional investments

Are these trends putting pressure on current stocks and prices? ‘Definitely’, says Graeme Train. ‘Demand for metal and zinc has outstripped supply for several years, causing short-term shortages. According to market logic,

The current complexity of financial markets and the global economy makes gauging certain developments a complex puzzle. Predicting the costs of current mining and zinc smelting projects is also particularly challenging due amongst other things to volatile energy markets.’

Graeme Train,

Head of Metals & Minerals Analysis at Trafigura

that drives up commodity prices. But the upside of that is that higher prices encourage longer-term investment in increasing a sustainable supply of raw materials and production facilities.’ The expert sees this as achievable, inter alia through opening new mines, boosting metal recycling capacities and investing in even more energy-efficient production methods. He also applies that vision in his job. ‘The current complexity of financial markets

and the global economy makes gauging certain developments a complex puzzle. Predicting the costs of current mining and zinc smelting projects is also particularly challenging due amongst other things to volatile energy markets.’

Carbon Agenda

The ‘carbon agenda’ further influences the market expert’s job. ‘We are getting more and more requests from customers to gain an insight into the carbon footprint of the commodities Trafigura sells to them. We have therefore developed several solutions to quantify the greenhouse gas emissions of metals and minerals based on production methods, raw material and ore sources, and the associated logistics.’

‘This is exactly the transparency we need to get cradle-to-gate insights and to make the entire metal sector ever more sustainable. With the future looking promising for the raw materials sector, we are taking the necessary steps today to develop that future as sustainably as possible.’

Higher commodity prices also encourage investment in metal recycling capacities.

Graeme Train,

Head of Metals & Minerals Analysis at Trafigura